To understand the silver squeeze, you first need to know the meaning of a short squeeze. Short-sellers borrow shares of stocks that they expect to drop in price. Then they sell the stock and attempt to buy it back at a much lower price. In January 2021, GameStop and AMC weren’t the only stocks experiencing major swings fueled by certain Reddit communities. A user in the WallStreetBets forum posted about an attempt to create a short squeeze on silver futures. Silver is different in many ways from individual stocks like GameStop, AMC, Blackberry and many more.

It has a wide industrial use on the one hand and it is a monetary “StoreOfValue” asset on the other. This gives it a unique characteristics to perform superbly under the widest range of the future outcomes. And when the FED joins the party of negative rates, this sum will double instantly.

Gold price edges lower, while WTI crud…

SLV is one way to get involved, although you should always be aware of the risks in any kind of short squeeze. However, if that stock’s price increases drastically, it can cause short sellers to lose money by having to buy back at the higher prices to minimize losses. The silver squeeze is caused by investors buying up silver in an attempt to drive up prices and “squeezing” the investors. There are reports that they are paying high premiums even for large 1000 oz. Bars (a sign of shortage) and that the inventories on the commodity exchanges are not big enough to the 5 best cryptocurrencies to invest in for 2021 last much longer should the buying of physical silver continue at the current rate. J.P. Morgan Chase is one of the largest traders of precious metals, so the Reddit user mentioned taking on the banking giant.

Gold to hit $2,700 in early 2025 amid softening cyclical environment – Goldman Sachs

The idea behind the “silver squeeze” thesis is that big banks and hedge funds currently have massive short positions in the silver market for the purpose of suppressing the price of the precious metal. According to this theory, if enough small investors buy into the silver market, the big banks and hedge funds will be forced to cover or buy back their short positions, which would send the price of silver soaring. You should familiarise yourself with these risks before trading on margin. Reddit retail traders have once again taken a position against hedge funds and money managers. The hashtag «Silversqueeze» is top trending on social media channels, including Twitter and Reddit, and retail traders are buying silver like there is no tomorrow. Silver crossed above the $30 mark earlier today, and silver ETFs experienced a massive inflow on Friday.

At various times, Robinhood has suspended purchasing for some meme stocks, a move that sparked almost universal outrage prompting angry consumers to tank the app’s rating on online stores with a flurry of one star reviews and politicians vowing to investigate. At its peak, Robinhood restricted trades from 50 companies, including GameStop, AMC Entertainment, BlackBerry and Nokia. For some reason, though, talk of a silver squeeze hasn’t Vps for trading subsided. That’s because the precious metal is heavily shorted – meaning there’s a large number of futures contracts predicting the price will drop. If this doesn’t happen, “shorts” will have to pay the difference in price.

“Why not squeeze $SLV to real physical price,” the user added, referring to the iShares Silver Trust, the world’s largest silver exchange-traded fund. On Twitter, #silversqueeze was trending as investors turned their attention to the latest market strategy to emerge from the “WallStreetBets” forum on Reddit. Kitco NEWS has a diverse team of journalists reporting on the economy, stock markets, commodities, cryptocurrencies, mining and metals with accuracy and objectivity. Our goal is to help people make informed market decisions through in-depth reporting, daily market roundups, interviews with prominent industry figures, comprehensive coverage (often exclusive) of important industry events and analyses of market-affecting developments.

Its goal is to closely mimic the performance of the price of silver. «Shares of the Trust are not subject to the same regulatory requirements as mutual funds,» according to the iShares site. Many smart investors have recognised that this is a dangerous path (for the stability and survival of our currencies and fixed income assets (bonds, cash deposits)) but also that it will provide an outsized investing opportunities. And that the most robust saving & investing opportunity one can grab in a given situation is to buy silver. If you are familiar with the word “anti-fragile”, you’ll see why it is the perfect word to describe silver in the current situation.

Find out more about IG

In addition to this, today’s one-day percentage gain is the biggest since 2008. The below silver chart shows the one-day percentage change in price. In fact, we could make an argument that WallStreetSilver single handedly created the current drive to buy physical silver.

- So if you buy a mere 20 ounces, you’ll own much more than the average person will ever have a chance to buy and hold.

- He graduated with master’s degrees in Biological Natural Sciences and the History and Philosophy of Science from Downing College, Cambridge University.

- There are reports that they are paying high premiums even for large 1000 oz.

- And all of the sudden small and large silver bullion dealers were out of inventory and they started buying physical inventory big time.

For a while in February, silver was the talk of the Trade silver town in the precious metals world. Internet searches related to buying gold had long dominated similar searches for silver. One look at Google Trends, though, shows that silver overshadowed the yellow metal for an entire week. The move into silver gained traction Thursday after posts on the “Wall Street Bets” Reddit forum urged investors to pile into physical silver, encouraging them to push the price of the metal up to $1,000. Silver has rallied in recent trading days after users on the forum posted about executing a “short squeeze” similar to ones that drove recent gains in stocks like GameStop and AMC.

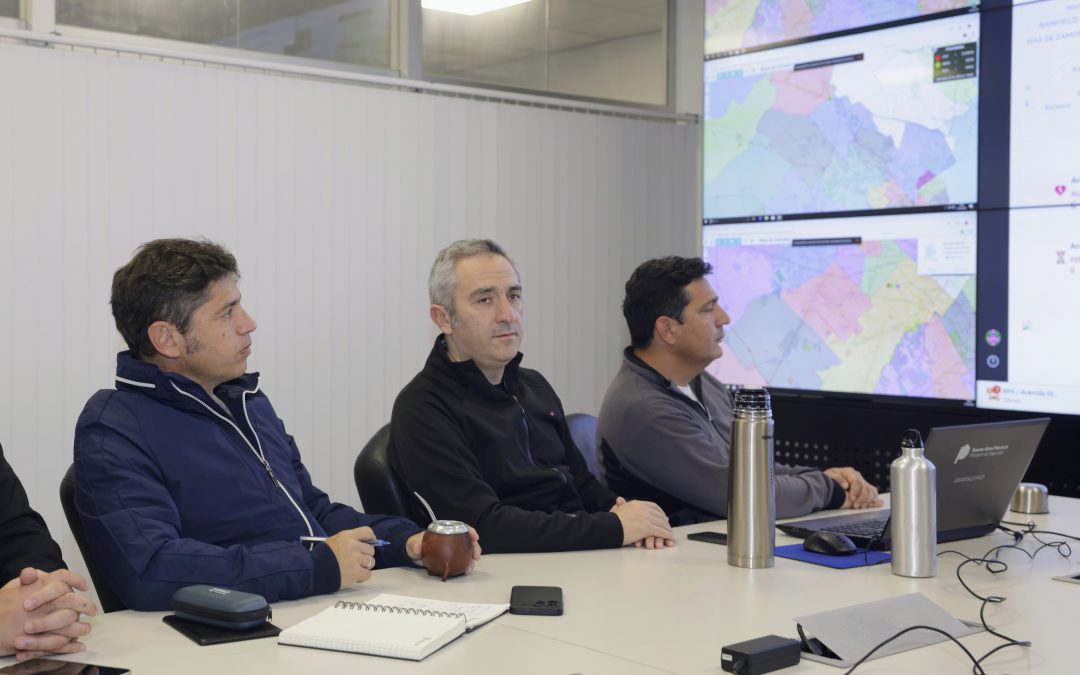

Some of the biggest recent happenings in the investment world have arisen thanks to users of the Reddit website and app. The insane increases seen in GameStop and AMC share prices had their inception in the WallStreetBets community, and the big news in silver is at least partially attributable to WallStreetSilver. Shares of precious metal miners that stand to benefit from higher silver prices soared Monday, with both Coeur Mining and Pan American Silver up by double digits. I believe that chart analysis is a tool that is helpful for determining if a large move is likely ahead in the silver market.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. There are rumblings of a potential “silver squeeze” ahead as Reddit traders attempt to replicate last week’s GameStop GME short-squeeze in the silver market. As a long-time believer in hard assets such as gold and silver, that is a thesis that I can get excited about (unlike GameStop, which is extremely overvalued).

That is partly what helped fuel a massive surge in GameStop last week. The most actively traded futures contracts for the precious metal climbed to their highest level in almost eight years Monday, extending recent gains as the Reddit-fueled buying frenzy spilled over into the commodities market. Some people were posting pics of the silver they were buying on Reddit (r/WallStreetSilver is a home of #SilverSqueeze community on Reddit), some were posting on Twitter, some on Facebook, some on Instagram and TicToc.

0 comentarios